What Is The Income Tax Rate In Kansas City Mo . residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. missouri has a progressive income tax rate that ranges from 0% to 4.95%. Missouri’s two largest cities, kansas city and st. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income.

from kansaspolicy.org

the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. missouri has a progressive income tax rate that ranges from 0% to 4.95%. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. Missouri’s two largest cities, kansas city and st.

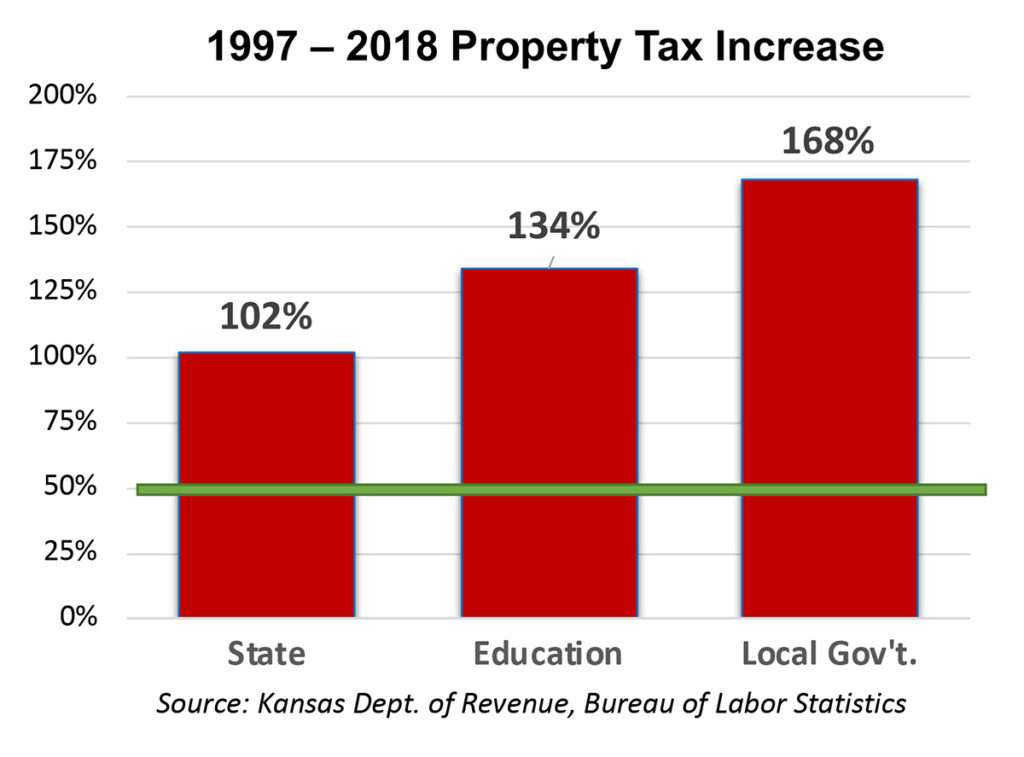

5 things you need to know about property taxes in Kansas Kansas

What Is The Income Tax Rate In Kansas City Mo the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. missouri has a progressive income tax rate that ranges from 0% to 4.95%. Missouri’s two largest cities, kansas city and st. the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings.

From rebekkahwlona.pages.dev

2024 Kansas Tax Brackets Nari Tamiko What Is The Income Tax Rate In Kansas City Mo missouri has a progressive income tax rate that ranges from 0% to 4.95%. the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. Missouri’s two largest cities, kansas city. What Is The Income Tax Rate In Kansas City Mo.

From barberfinancialgroup.com

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group What Is The Income Tax Rate In Kansas City Mo residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. Missouri’s two largest cities, kansas city and st. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. missouri has a progressive income tax rate. What Is The Income Tax Rate In Kansas City Mo.

From dxolfranm.blob.core.windows.net

What Is The Sales Tax On Alcohol In New York at Joseph Neal blog What Is The Income Tax Rate In Kansas City Mo missouri has a progressive income tax rate that ranges from 0% to 4.95%. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. Missouri’s two largest cities, kansas city and st. the income tax rates for the 2023 tax year (which you file in. What Is The Income Tax Rate In Kansas City Mo.

From www.kansascity.com

Do you know about the 2017 Kansas tax rate changes? Tax rates in What Is The Income Tax Rate In Kansas City Mo missouri has a progressive income tax rate that ranges from 0% to 4.95%. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. Questions answered. What Is The Income Tax Rate In Kansas City Mo.

From exoenscoe.blob.core.windows.net

What S The Tax Rate In Kansas at Patricia Alexander blog What Is The Income Tax Rate In Kansas City Mo Missouri’s two largest cities, kansas city and st. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. missouri has a progressive income tax rate that ranges from 0% to 4.95%. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or. What Is The Income Tax Rate In Kansas City Mo.

From www.pdffiller.com

2018 Form MO RD109 Kansas City Fill Online, Printable, Fillable What Is The Income Tax Rate In Kansas City Mo this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. missouri has a progressive income tax rate that ranges from 0% to 4.95%. Missouri’s two largest cities, kansas city. What Is The Income Tax Rate In Kansas City Mo.

From www.city-data.com

Kansas City, Missouri (MO) map, earnings map, and wages data What Is The Income Tax Rate In Kansas City Mo the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income.. What Is The Income Tax Rate In Kansas City Mo.

From auntieannesnetincomezentai.blogspot.com

Auntie AnneS Net March 2018 What Is The Income Tax Rate In Kansas City Mo Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. Missouri’s two largest cities, kansas city and st. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. missouri has a progressive income tax rate. What Is The Income Tax Rate In Kansas City Mo.

From fanbmarice.pages.dev

Tax Standard Deduction 2024 Pdf Download Ilka Karmen What Is The Income Tax Rate In Kansas City Mo this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. Missouri’s two largest cities, kansas city and st. residents of kansas city pay a flat city income tax of. What Is The Income Tax Rate In Kansas City Mo.

From taxfoundation.org

How Much Does Your State Rely on Individual Taxes? What Is The Income Tax Rate In Kansas City Mo Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. missouri has a progressive income tax rate that ranges from 0% to 4.95%. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. Missouri’s two. What Is The Income Tax Rate In Kansas City Mo.

From dorisaqmelonie.pages.dev

Indiana State Tax Rate 2024 Patty Bernelle What Is The Income Tax Rate In Kansas City Mo residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Missouri’s two largest cities, kansas city and st. Questions answered in this section include, “what is. What Is The Income Tax Rate In Kansas City Mo.

From milliezcelene.pages.dev

New York State Standard Deduction 2024 minimalmuse What Is The Income Tax Rate In Kansas City Mo residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. missouri has a progressive income tax rate that ranges from 0% to 4.95%. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Questions answered. What Is The Income Tax Rate In Kansas City Mo.

From dxoxupsqr.blob.core.windows.net

What Is The Time Zone In Kansas City Missouri at Mana Barnes blog What Is The Income Tax Rate In Kansas City Mo Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. missouri has a progressive income tax rate that ranges from 0% to 4.95%. Missouri’s two. What Is The Income Tax Rate In Kansas City Mo.

From valentiawemma.pages.dev

Kansas State Tax 2024 Prudi Regine What Is The Income Tax Rate In Kansas City Mo this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. the income tax rates for the 2023 tax year (which you file in 2024) range. What Is The Income Tax Rate In Kansas City Mo.

From usafacts.org

Which states have the highest and lowest tax? USAFacts What Is The Income Tax Rate In Kansas City Mo Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%.. What Is The Income Tax Rate In Kansas City Mo.

From kansaspolicy.org

5 things you need to know about property taxes in Kansas Kansas What Is The Income Tax Rate In Kansas City Mo missouri has a progressive income tax rate that ranges from 0% to 4.95%. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. Missouri’s two. What Is The Income Tax Rate In Kansas City Mo.

From taxfoundation.org

State Tax Rates and Brackets, 2022 Tax Foundation What Is The Income Tax Rate In Kansas City Mo the income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%. Questions answered in this section include, “what is the earnings tax?” and “who has to file and/ or pay earnings. missouri has a progressive income tax rate that ranges from 0% to 4.95%. residents of kansas city pay. What Is The Income Tax Rate In Kansas City Mo.

From www.youngresearch.com

How High are Tax Rates in Your State? What Is The Income Tax Rate In Kansas City Mo missouri has a progressive income tax rate that ranges from 0% to 4.95%. this calculator estimates the average tax rate as the state income tax liability divided by the total gross income. residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and. Missouri’s two. What Is The Income Tax Rate In Kansas City Mo.